Answer:

The selling price of the bonds is $1,302,362.43

Step-by-step explanation:

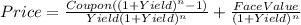

Hi, in order to find the present value of the bonds, we need to use the following formula.

Where:

Coupon = the semi-annual interest payment (1,200,000*(8%/2)=48,000)

Yield = Annual market rate (2.96%)

n = Number of semi-annual payments (5 years*2 = 10 semesters)

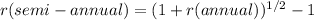

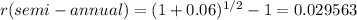

Let me show you how to convert an effective annual rate (annual market rate) into a semi-annual effective rate.

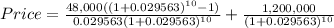

Everything should look like this.

Therefore, the price is $1,307,074.18

Best of luck