Answer:

market value of Lawrence's shares is $34.113

Step-by-step explanation:

given data

annual dividend = $1.80 per share

Current year dividend Do = $ 1.80

required return = 11%

dividends expected grow = 8% annually

time = 3 year

growth rate = 5%

to find out

the market value of Lawrence's shares

solution

we will apply here Gordon Growth Model for terminal value in year 3 that is

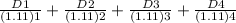

Gordon Growth Model P3 =

and

=

=

here r is required return and G is growth rate and D1 is Expected dividend of next 1 year

so here we get D1, D2, D3 and D4 they are as

D1 = $1.8×(1+0.08)

D1 = $1.944

and

D2 = $1.944×(1+0.08)

D2 =$2.0995

and

D3 = $2.0995×(1+0.08)

D3 = $2.267

and

D4 = $2.267×(1+0.05)

D4= $2.38

so

we get here now market value of the share year 3rd end that is

P3 =

P3 = $39.67

and

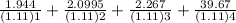

Market value of the share today is

Market value =

put here all value

Market value =

solve we get

Market value = $34.113

so market value of Lawrence's shares is $34.113