Answer:

The 95% confidence interval is between -21.2% and 63.6% (option D).

Step-by-step explanation:

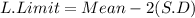

Hi, the empirical rule dictates that 95% of the data is found within +/- 2 standard deviations from the mean, therefore our interval can be found doing the following calculations.

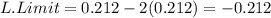

That is:

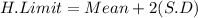

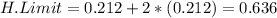

Now, the higher limit.

So, the answer is D) -21.2%, 63.6%

Best of luck.