Answer:

The monthly payment amount would be $821.69

Step-by-step explanation:

Hi, since you have already paid $15,000 (down payment), the amount of money to be financed is $130,000 ($145,000 - $15,000). Knowing that, we need to solve the following equation for "A".

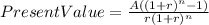

Where:

Present Value = money borrowed (in our case, $130,000)

r = effective interest rate (in our case, 6.5%/12= 0.5417% or 0.005417)

n = number of periodic payments (in our case, 30*12=360 monthly payments)

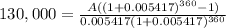

Everything should look like this.

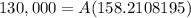

Therefore:

So, the monthly payments would be equal to $821.69.

Best of luck.