Answer:

If we compare the p value and the significance level given

we see that

we see that

so we can conclude that we have enough evidence to FAIL to reject the null hypothesis, so we can conclude that the mean P/E ratio of all socially conscious stocks it's not significantly different from the mean P/E ratio of the S&P Stock Index (19.4) at 5% of signficance.

so we can conclude that we have enough evidence to FAIL to reject the null hypothesis, so we can conclude that the mean P/E ratio of all socially conscious stocks it's not significantly different from the mean P/E ratio of the S&P Stock Index (19.4) at 5% of signficance.

Step-by-step explanation:

1) Data given and notation

represent the P/E ratio sample mean

represent the P/E ratio sample mean

represent the sample standard deviation

represent the sample standard deviation

sample size

sample size

represent the value that we want to test

represent the value that we want to test

represent the significance level for the hypothesis test.

represent the significance level for the hypothesis test.

z would represent the statistic (variable of interest)

represent the p value for the test (variable of interest)

represent the p value for the test (variable of interest)

2) State the null and alternative hypotheses.

We need to conduct a hypothesis in order to check if the mean P/E ratio of all socially conscious stocks is different (either way) from the mean P/E ratio of the S&P Stock Index (19.4) :

Null hypothesis:

Alternative hypothesis:

Since we don't know the population deviation, is better apply a t test to compare the actual mean to the reference value, and the statistic is given by:

(1)

(1)

t-test: "Is used to compare group means. Is one of the most common tests and is used to determine if the mean is (higher, less or not equal) to an specified value".

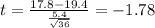

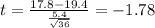

3) Calculate the statistic

We can replace in formula (1) the info given like this:

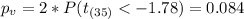

4) P-value

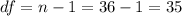

First we need to calculate the degrees of freedom given by:

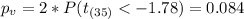

Since is a two-sided test the p value would be:

5) Conclusion

If we compare the p value and the significance level given

we see that

we see that

so we can conclude that we have enough evidence to FAIL to reject the null hypothesis, so we can conclude that the mean P/E ratio of all socially conscious stocks it's not significantly different from the mean P/E ratio of the S&P Stock Index (19.4) at 5% of signficance.

so we can conclude that we have enough evidence to FAIL to reject the null hypothesis, so we can conclude that the mean P/E ratio of all socially conscious stocks it's not significantly different from the mean P/E ratio of the S&P Stock Index (19.4) at 5% of signficance.