Answer:

$5,100

Step-by-step explanation:

Initial cash balance (IB) = $32,500

Expected cash receipts (EC) = $48,500.

Cash disbursements (CD) = $56,100

Amount borrowed (B) = ?

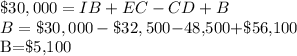

Assuming that the final balance must equal at least $30,000, the cash flow for april is given by:

Sit Down Corporation will need to borrow $5,100 during April to maintain a minimum cash balance of $30,000.