Answer:

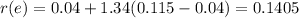

The firm's cost of equity is C. 14.05 percent

Step-by-step explanation:

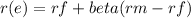

Hi, we need to use the following formula in order to find the cost of equity of this firm.

Where:

r(e) = Cost of equity

rf = risk free rate

rm = Market rate of return

Everything should look like this.

So, this firm´s cost of equity is 14.05%

Best of luck