Answer:

MIRR = 16%

so correct option is B. 16%

Step-by-step explanation:

given data

project costs = $275,000

after tax cash flows = $73,306

time = 8 year

cost of capital = 12 percent

to find out

What is the project’s MIRR

solution

we first find here Future value of annuity that is express as

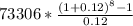

Future value of annuity =

............1

............1

here A is annuity and r is rate and t is time period

put here value

Future value of annuity =

Future value of annuity = 901641.30

so MIRR will be here

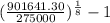

MIRR =

................2

................2

here FV is future value and PV is present value and t is time period

put here value

MIRR =

MIRR = 16%

so correct option is B. 16%