Answer:

a) 548,000 shares

b) The stated value = $3 per common stock.

c) The par value of the preferred stock = $100

d) The dividend rate of preferred stock = 7%

e) Reported for retained earnings = $1,079,600

Step-by-step explanation:

A. Number of outstanding common stock = Number of Common stock - Treasury stock

Given,

Number of Common stock issued = 555,000 shares

Treasury stock = 7,000 common shares

Treasury stock is the purchasing of the company's own stock from the market.

Therefore, Number of outstanding common stock = (555,000 - 7,000) shares

Number of outstanding common stock = 548,000 shares.

B.

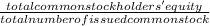

The stock of the firm has no par value. It means the full amount is either in the premium or in stated value. Therefore, the firm's declared value of the common stock is the total common stockholders' equity divided by the total number of common stock issued.

Hence, the formula is,

The stated value =

The stated value =

The stated value = $3 per common stock.

C.

We know,

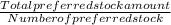

The par value of the preferred stock =

Given,

Total preferred stockholders' equity = $710,000

Number of preferred stock = 7,100 shares

Putting the value in the formula,

The par value of the preferred stock =

The par value of the preferred stock = $100

It is the selling price to the preferred stockholders for every preferred stock.

D.

Given,

The annual dividend = $49,700

Total preferred stockholders' equity = $710,000

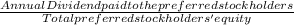

We know, the dividend rate of preferred stock =

x 100

x 100

Therefore,

The dividend rate of preferred stock =

x 100

x 100

The dividend rate of preferred stock = 7%

This is a fixed rate and for this firm, it is cumulative. Therefore, the firm's preferred stockholders' will receive 7% dividend per year.

E.

Since the preferred stock of this firm is cumulative, therefore, the dividend has to be paid to the preferred stockholders if there are any outstanding amount remains in the previous year. Therefore, if there were $71,400 arrears of dividends, the firm would give those amounts from the retained earnings' balance.

Given,

Retained earnings = $1,151,000

Arrear preferred dividend = $ (71,400)

The balance would be reported for retained earnings = $1,079,600