Answer:

$4500

Step-by-step explanation:

Given: Purchase cost of Van= $40000

Estimated useful life= 8 years

residual value= $4000

As given we have to use straight line method for finding depreciation expense;

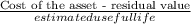

Formula, Depreciation expense=

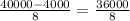

Annual depreciation expense=

∴ Depreciation expense=

We know that in straight line method of depreciation, depreciation expense will remain same for all useful life of asset, however, book value changes.

∴ Depreciation expense for second year will also be $4500.