Answer:

$22000 and $50000.

Step-by-step explanation:

Given: Purchased value of equipment- $72000.

Residual value- $6000

Estimated useful life of equipment- $ 5 years.

Now, finding value of depreciation for 2011 using the sum of the years digits method.

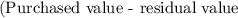

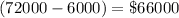

Depreciation cost=

⇒ Depreciation cost=

∴ Depreciation cost= $66000.

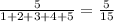

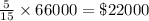

Depreciation fraction for 1st year=

Depreciation expense for 1st year=

∴ Depreciation for 2011 is $22000.

Next, lets find out the book value at the end of first year.

Book value=

Book value=

∴ Book value at December 2011 is $50000.