Answer:

Option D.

Explanation:

Given information:

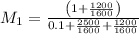

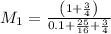

Required reserve ratio (rr)= 10%= 0.1

Currency in circulation (C)= $1,200 billion

Checkable deposits (D)= $1,600 billion

Excess reserves total (ER)= $2,500 billion

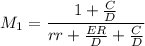

The formula for the M1 money multiplier is

where, C is currency in circulation, D is deposits, ER is excess reserve and rr is required reserve ratio.

Substitute the given values in the above formula.

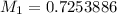

The M1 money multiplier is 0.73. Therefore, the correct option is D.