Answer:

$33.93

Step-by-step explanation:

First, find the present value of each year's dividend at 15% required rate of return;

(PV of D1 ) = 4.40 / (1.15) = 3.8261

(PV of D2 ) = 4.50 / (1.15²) = 3.4026

Next, find terminal Cashflow;

D3 = D2 (1+g)

D3 = 4.50 (1.02) = 4.59

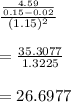

(PV of D4 onwards ) =

Next sum up the PVs to find price;

=3.8261 + 3.4026 + 26.6977

= 33.926

Therefore, this stock is worth $33.93 today