Answer:

C. $65,000

Step-by-step explanation:

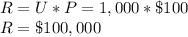

Units produced (U) = 1,000

Selling price (P) = $100 per unit

Fixed overhead costs = $30,000

Fixed selling and administrative expenses = $15,000

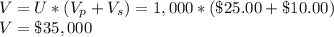

Variable production costs (Vp) = $25.00 per unit

Variable selling and administrative expenses (Vs) = $10.00 per unit

Contribution margin (CM) is defined as Sales revenue (R) minus variable costs (V). Thus, fixed costs should not be considered. Sales revenue is given by:

Variable costs are given by:

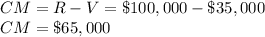

Therefore, the contribution margin is: