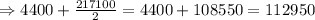

The life insurance need is $112950

Solution:

Given that,

Mortgage =

Auto loan =

Credit card balance =

Personal debts =

Funeral expenses =

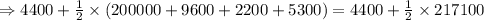

To find the life insurance needs using DINK method, we have use the following formula,

![\Rightarrow\text { funeral expensss }+\left[(1)/(2) * \text { (mortgage }+\text { auto loan }+\text { credit card balance }+\text { other debts }\right]](https://img.qammunity.org/2020/formulas/mathematics/high-school/pcr5zpdu7tv8d0ykxr03zyo3ij4h49b3jj.png)

On substituting the values we get,

The term DINK stands for Double Income, No Kids. This method has you adding half of all your debts plus funeral expenses.