Answer:

Expected rate of return on the portfolio is 8.46

Step-by-step explanation:

RR: Rate of return

Stock has

= 13.68,

= 13.68,

= 1.24

= 1.24

Risk-free asset has

= 2.8,

= 2.8,

= 0

= 0

(Yield can be considered equivalent to RR here)

Let

be the weight of the assets.

be the weight of the assets.

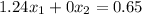

Portfolio's beta is given by:

Beta =

= 0.65

= 0.65

=>

=>

= 0.52

= 0.52

=>

= 1 - 0.52 = 0.48

= 1 - 0.52 = 0.48

Rate of return of the portfolio is given by

RR=

= (0.52 * 13.68) + (0.48 * 2.8) = 8.46

= (0.52 * 13.68) + (0.48 * 2.8) = 8.46