Answer: Investment's coefficient of variation is 0.22.

Explanation:

Since we have given that

Expected return = 45%

Standard deviation = 10%

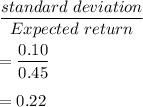

We need to find the coefficient of variation.

So, Coefficient of variation is given by

Hence, investment's coefficient of variation is 0.22.