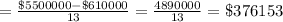

$ 376153 is depreciation on the building for 2018.

Step-by-step explanation:

Given data:

Original cost = $13.1 million

Residual value = $2.1 million

Useful life = 20 -year

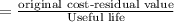

Depreciation on the building for 2016 =

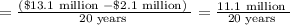

By substituting the given values, we get,

= 5500000

= 5500000

Depreciation for 2016 $5500000

Depreciation for 2017 $5500000

Depreciation at Dec 31, 2017 $ 5500000

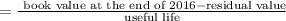

In 2018, the estimates of useful life and residual value were changed to 15 years and $610000, but 2 yrs have already passed, so there're 13 more yrs to go.

Depreciation on the building for 2018,

=