Answer:

$0.5 million

Step-by-step explanation:

Given: Net sales= $326.7 million

Current liabilities, beginning of year $41.1 million

Current liabilities, end of year $62.4 million

Net cash provided by operating activities $10.4 million

Total liabilities, beginning of year $65.2 million

Total liabilities, end of year $73.2 million

Capital expenditures $3.7 million

Cash dividends $6.2 million

Now, compute free cash flow.

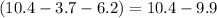

Formula: Free cash flow=

Free cash flow=

∴ Free cash flow= $0.5 million

Free cash flow of firm is useful to know the profitability of company excluding all non cash expense from firm´s income statement.