Answer:

9.09%

Step-by-step explanation:

Use Gordon growth model of stock valuation to find the required rate of return;

Price = D1/ (r-g)

this can also be written as

whereby,

Price = $35.41

D0 = Current dividend = 1.38

D1 = Next year's dividend = 1.38(1.05) = 1.449

g = growth rate = 5% or 0.05 as a decimal

r = required return = ?

Rewrite the formula "Price = D1/ (r-g) " to find r;

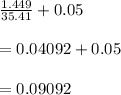

r =

r =

as a percentage, the required return = 9.09%