Answer:

B. $19.09

Step-by-step explanation:

D1 = $0.50

D2 = $1.00

D3 = $1.50

D4 = $2.00

D5 = D4(1+g)

and g is given as 6%

D5 = 2.00(1.06) = 2.12

Next, find the PV of each dividend at a discount rate of 14%

PV(D1) = 0.50/(1.14) = 0.4386

PV(D2) = 1.00/(1.14²) = 0.7695

PV(D3) = 1.50/(1.14³) = 1.0125

PV(D4) = 2.00/(1.14^4) = 1.1842

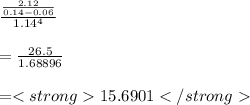

Find the present value of the terminal value (D5 onwards);

PV(D5 onwards) =

Sum up the PVs to find the current value of the stock;

= 0.4386 + 0.7695 + 1.0125 + 1.1842 + 15.6901

= 19.0949

Therefore, the current value = $19.09