Answer:

The amount of VAT paid by Jeremy is €9.31.

Explanation:

Given;

Total Amount paid by Jeremy = €58.31.

VAT = 19 %

We need to find the VAT amount paid by Jeremy.

Let the Actual amount of calculator be x

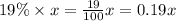

VAT Amount =

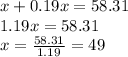

Hence Total amount will be equal to actual price plus VAT amount.

Hence the Actual amount of calculator is €49.

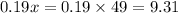

Now VAT amount =

Hence, the amount of VAT paid by Jeremy is €9.31.