Answer:

The equal payments amount is $16,678.57

Step-by-step explanation:

Hi, first we need to determine what the loan amount is, we can do that by substracting $25,000 (down payment) from the cost of the new house, that would be $170,000 - $25,000 = $145,000.

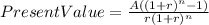

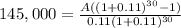

Now, we need to solve for "A" the following equation, given a rate of 11% compounded annually, number of yearly payments equals 30 and a present value of $145,000

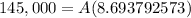

Everything should look like this.

Therefore, A = $16,678.57

Best of luck.