Answer:

0.0416483 or 4.16%

Explanation:

Annual percentage rate, APR = 4%

Value of toys sold = $200,000

Note period = 90 day

N = 365 ÷ 90

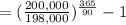

= $200,000 × [1 - (0.04 × 90/360)]

= $198,000

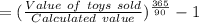

Effective annual financing cost:

= 1.0416483 - 1

= 0.0416483 or 4.16%