Answer:

cost of land record = $206550

Step-by-step explanation:

given data

market value of the land = $320000

market value of the building = $470000

acquired both land and building = $510000

to find out

amount should the corporation record the cost of land

solution

first we find market value to total assets that is

market value to total assets = market value of the land + market value of the building ......................1

put here value

market value to total assets = $320000 + $470000

market value to total assets = $790000

and

share of land in the total market that is

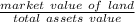

share of land in the total market =

.......................2

.......................2

put here value

share of land in the total market =

share of land in the total market = 40.50 %

and

cost of land record = share of land in the total market × acquired both land and building .......................3

put here value

cost of land record = $510000 × 40.50%

cost of land record = $206550