Answer:

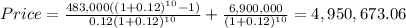

The amount that Bonita will realize from the sale is $4,950,673.06

Step-by-step explanation:

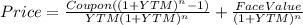

Hi, first, we need to find the amount to be paid by the bond (coupon), that is 7%*$6,900,000=$483,000. Now, we can use the following formula.

Where:

YTM = 0.12

n = 10

Face Value = $6,900,000

Coupon = $483,000

Price = what Bonita

Therefore:

Best of luck.