Answer:

The return on equity ratio is 17.1%

Explanation:

Given:

Net sales = $ 200,000

Cost of goods sold = $40,000

Net income = $60,000

Last year's total assets = $900,000

This year's total assets =$1,100,000.

Shareholders' equity last year= $300,000

Shareholders' equity this year = $400,000

To Find:

Return on equity ratio=?

Solution:

The return on equity ratio or ROE is a profitability ratio that measures the ability of a firm to generate profits from its shareholders investments in the company. In other words, the return on equity ratio shows how much profit each dollar of common stockholders’ equity generates.

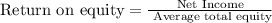

It is obtained using the below formula,

...............(1)

...............(1)

Here ,

average total equity

=>

=>

=>350,000

Now substituting the values in equation (1), we get

=>0.17

Converting into percentage, we get

=>

=>17.1%