Answer:

$328000

Step-by-step explanation:

Given: Cost of machine= $880000

Residual value= 60000

Estimated life= 10 years

Company use straight line depreciation method.

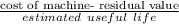

∴ Depreciation =

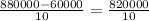

⇒ Depreciation=

∴ Depreciation=

per year.

per year.

Now, lets find the value of depreciation.

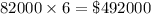

∵ Machine is sold on December 31, 2019, which is 6 years after it is installed.

∴ Depreciation value after 6 years=

Depreciation value after 6 years=

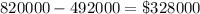

Next, finding the value of machine after 6 years of depreciation.

Value of machine after 6 years=

∴ Disposal value of machine after 6 years of usage is

, however, machine was sold at $225000.

, however, machine was sold at $225000.