Answer:

The aftertax salvage value of the machine is D) $10,134

Step-by-step explanation:

Hi. first, we need to find out the book value of the machine at the selling date, that is 3 years from now, and the book value is as follows.

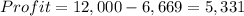

Since taxes are based on the profit you make by selling something, our profit is:

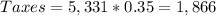

Therefore, our taxes are:

So, the after tax salvage value of the machine is the money you received on the sale minus the taxes you have to pay, that is:

Salvage Value of the Machine = $12,000 - $1,866?= $10,134

That is option D)

Best of luck.