Answer:

a) Annual depreciation = $15,416.67

b) Depreciation rate = 0.2615

Step-by-step explanation:

Data provided in the question:

Cost of router = $190,000

Useful life = 12 years

Salvage value = $5,000

Now,

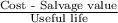

a) Using straight-line depreciation

Annual depreciation =

=

= $15,416.67

Hence,

Year Depreciation Book value

1 $15,416.67 $190,000 - $15,416.67 = $174,583.33

2 $15,416.67 $174,583.33 - $15,416.67 = $159166.66

3 $15,416.67 $159166.66 - $15,416.67 = $143749.99

4 $15,416.67 $143749.99 - $15,416.67 = $128333.32

5 $15,416.67 $128333.32 - $15,416.67 = $112916.65

6 $15,416.67 $112916.65 - $15,416.67 = $97499.98

7 $15,416.67 $97499.98 - $15,416.67 = $82083.31

8 $15,416.67 $82083.31 - $15,416.67 = $66666.64

9 $15,416.67 $66666.64 - $15,416.67 = $51249.97

10 $15,416.67 $51249.97 - $15,416.67 = $35833.3

11 $15,416.67 $35833.3 - $15,416.67 = $20416.63

12 $15,416.67 $20416.63 - $15,416.67 = $4999.96

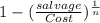

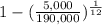

b) using declining balance depreciation

Depreciation rate =

here, n = useful life

thus,

Depreciation rate =

= 0.2615

Therefore,

Year Depreciation Book value

1 0.2615 × $190,000 $190,000 - $49685 = $140315

2 0.2615 × $140315 $140315 - $36692.3725 = $103622.62

3 0.2615 × $103622.6 $103622.62 - $27097.30 = $76525.32

4 0.2615 × $76525.32 $76525.32 - $20011.37 = $56513.95

5 0.2615 × $56513.95 $56513.95 - $14778.39 = $41735.56

6 0.2615 × $41735.56 $41735.56 - $10913.84 = $30821.72

7 0.2615 × $30821.72 $30821.72 - $8059.87 = $22761.85

8 0.2615 × $22761.85 $22761.85 - $5952.22 = $16809.63

9 0.2615 × $16809.63 $16809.63 - $4396.22 = $12413.41

10 0.2615 × $12413.41 $12413.41 - $3246.10 = $9167.31

11 0.2615 × $9167.31 $9167.31 - $2397.25 = $6770.06

12 0.2615 × $6770.06 $6770.06 - $1770.37 = $4999.69