Answer:

Vern's depletion deduction is $175000

Step-by-step explanation:

given data

mineral interest = $3,500,000

recoverable units = 500,000

mined = 40,000 units

sold = 25,000 units

depletion rate = 22%

to find out

Vern's depletion deduction

solution

we get here depletion expense that is

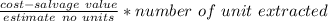

depletion expense =

...........................1

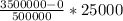

...........................1

put here value we get

depletion expense =

depletion expense = $175000

and

percentage depletion = $800,000 × 22%

percentage depletion = $176000

we know that % depletion method is not accept as IRS for certain natural resources

so we use depletion method is use here

Vern's depletion deduction is $175000