Answer:

Residual Value = $5,400

Step-by-step explanation:

At first, we have to calculate the cost of equipment.

Using double-declining method,

The depreciation as per 2023 = $30,000.

The depreciation rate to use the double-declining method = (100%/Useful life) x 2 = (100%/8) x 2 = 25%

Therefore, the beginning balance of equipment in 2023 (or, the ending balance in 2022) =

The beginning balance of equipment in 2023 = $120,000

Using the same approach,

The beginning balance of equipment in 2022 (Or, the purchasing price) =

Depreciation = Purchase price x 25%

since the purchase price and depreciation are unknown, therefore, we use,

Ending value in 2022 = Purchase price x (100% - 25%) (Depreciation rate is 100%)

or, $120,000 = Purchase price x 75%

or, Purchase price = $120,000/0.75 = $160,000

Now, using the straight-line method,

Useful life = 8 years

Purchase price = $160,000

Book value after 4 years (As of December 2025, the equipment was purchased in January 2022) = $82,700

Therefore, accumulated depreciation = $160,000 - 82,700 = $77,300 for 4 years.

As the straight-line method depreciation is same for each year,

the depreciation for the first year =

= $19,325

= $19,325

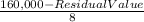

According to the straight-line method,

Depreciation =

or, $19,325 =

or, $19,325 x 8 = $160,000 - Residual value

or, Residual Value = $160,000 - $154,600

Hence, Residual value = $5,400