Answer:

The yield to maturity of the bonds is 11%

Step-by-step explanation:

Price at which the bonds is currently trading = 283.30$

Face Value = $1000

Coupon rate = 2%

Hence the coupon bond rate = $1000 ×2%

=

=$20

Years to maturity: 20 years

Formula used:

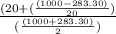

=

Where C is the bond coupon rate

F is the face value

P is the price

N is the number of years

=

=11%

The yield to maturity of the bonds is 11%