Answer:

10.59%

Step-by-step explanation:

First, find next year's dividend using dividend discount model formula;

D1 = D0 (1+g)

D0 = current dividend paid = 1.70

D1 = expected next year's dividend

g = growth rate = 2.10% or 0.0210 as a decimal

therefore. D1 = 1.70 (1+0.0210)

D1 = 1.70 *1.0210

D1 = 1.7357

With the current price of $20.44, find the cost of stock (r) ;

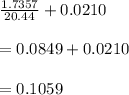

r =

P0 = Current price

r =

As a percentage, the cost of stock is 10.59%