Answer:

The total amount of the mortgage is $ 871879.4

Explanation:

Given as :

The cost of house = $ 175,000

The first 80% of mortgage amount = 80% of $ 175,000 = 140,000

The second 20 % of mortgage amount = 20% of $ 175,000 = 35,000

The rate of interest for 80 % mortgage = 4.75 %

The rate of interest for 20 % mortgage = 7.525 %

The time period for both mortgage is 30 years

Let The amount at 80 % mortgage =

And The amount at 20 % mortgage =

So, From compounded method

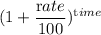

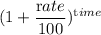

= principal ×

= principal ×

or,

= 140,000 ×

= 140,000 ×

Or,

= 140,000 ×

= 140,000 ×

Or,

= 140,000 × 4.02365

= 140,000 × 4.02365

Or,

= $ 563311

= $ 563311

Again

= principal ×

= principal ×

or,

= 35,000 ×

= 35,000 ×

Or,

= 35,000 ×

= 35,000 ×

Or,

= 35,000 × 8.81624

= 35,000 × 8.81624

Or,

= $ 308568.4

= $ 308568.4

∴ Total amount A =

+

+

I.e A = $ 563311 + $ 308568.4 = $ 871879.4

Hence The total amount of the mortgage is $ 871879.4 answer