The prepayment fee of $6182.58 would be charged to Artemis for paying off her loan 16 years early.

Answer: Option C

Explanation:

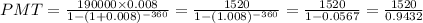

30 year loan at 9.6% interest yields.

Number of month = 30 (12) = 360 months

Annual percent interest of

= monthly percent interest of .8%

= monthly percent interest of .8%

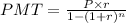

The formula for the present value of an ordinary annuity, as opposed to an annuity due, is as follows

With r and n adjusted for periodicity, where

P = the present value of an annuity stream

PMT = the dollar amount of each annuity payment

r = the interest rate (also known as the discount rate)

n = the number of periods in which payments will be made

PMT = $1611.50 per month

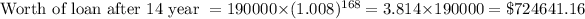

Her loan 16 year early. It means

Worth of monthly payments for 14 year

Amount still owed after 14 year = difference of the above two

=$724641.16 - $566825.18

=$157816.01

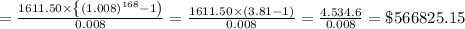

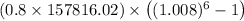

Prepayment fee =

= 126252.82 (1.049-1) = 126252.82 (1.0489-1) = $6182.63