Answer:

option (b) $35,556

Step-by-step explanation:

Given:

Cost of purchase of assets = $200,000

Asset Adjusted Basis Fair Market Value

Inventory $25,000 $50,000

Equipment $60,000 $40,000

Supplies $20,000 $20,000

Building $80,000 $95,000

Land $10,000 $20,000

Total $195,000 $225,000

Now,

since, fair market value is greater than Basis,

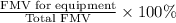

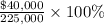

Percentage FMV on Equipment =

⇒ Percentage FMV on Equipment =

= 17.77%

thus,

Nanci's basis in the equipment = Percentage FMV × Assets

= 17.77% × $200,000

= $35,555.56 ≈ $35,556

Hence,

The correct answer is option (b) $35,556