Answer:

1003

Step-by-step explanation:

Given:

Period= 30 years, Loan amount= $200,000,

Payments- Monthly,

Teaser rate for first 2 years = 4%,

Annual payment cap=5%, Composite rate on reset date= 6%

Annual rate for 2 years =4%

Monthly rate will be 4/12 = 0.3333% = 0.003333

n=30years=360 months

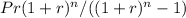

Monthly payment for first 2 years =

=

= 954.83

or by Excel function = PMT(0.003333,360,200000,0) = 954.83

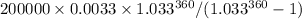

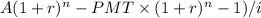

Loan balance after 2 years = PV(0.003333,336,-954.83,0) = 192,812.36 or

Balance=

=

= 192,812.36

Composite rate is 6% but payment is capped at 5%. So new payment from year 3 is 954.83×1.05=1002.57=1003