Answer:

a) $8480

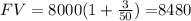

b) $8273.17

Explanation:

1) Notation

P the principal amount = $8000

Time for maturity = 9 months

I = 8% = 0.08 the simple interest

2)Formulas to use

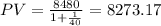

Future value with simple interest

(1)

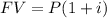

(1)

Where i represent the annual rate of interest, on this case since we have on 1 year 12 months we can do this:

3) Part a

Now we can replace in formula (1)

So then the value for the Certificate of deposit at the maturity would be $8480.

4)Part b

If the friend earns 10% annual simple interest, then the amount that Bill will recieve would be the present value from formula (1) with a future value FV= 8480

If we solve PV from equation (1) we got

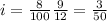

(2)

(2)

Where i would represent the following value

Since three months before the CD was due to mature, Bill needed his CD money, he just earns 3 months for the total of 12 in a year.

Then replacing into equation (2) we got: