Answer:

option (E) $36.75

Step-by-step explanation:

Given:

Dividend growth rate, g = 2% = 0.02

Required return, r = 14% = 0.14

Now,

The value of the stock

= Present value of ( Dividend of 4.40 to be received next year + Dividend of 4.50 to be received the year after the next year + Value of the share as at the beginning of the third year )

Thus,

The price of the share

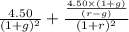

=

+

+

=

+

+

+

+

= 3.86 + 3.46 + 29.43

= $36.75

Hence,

the correct answer is option (E) $36.75