Answer: The dividend yield is $1851.

Explanation:

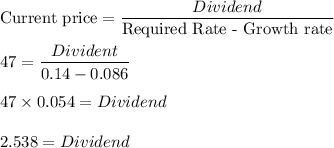

Since we have given that

Required return = 14% = 0.14

Growth rate = 8.6% = 0.086

Current price of stock = $47

So, we will use the formula below:

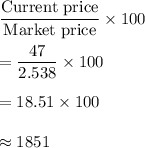

So, Dividend yield is given by

Hence, the dividend yield is $1851.