Answer:

i=4.84%

Step-by-step explanation:

the key to answer this question, is to remember the model of return for a perpeuity dividend calculation:

where value is the current stock price, i is the dividend yield and k is the growth rate, so applying to this particular case we have

k=3.4/91

k=3.74%

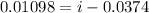

and solving i for the previous formula: