Answer:

8.42%

Step-by-step explanation:

If Bond price is equal to face value, then it means that YTM of the bond is also equal to coupon rate;

If YTM = Coupon rate, Price = Face value

Since the coupon rate = 8.25%, YTM (APR)= 8.25%

Next, find the Effective YTM or effective annual return(EAR) ;

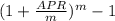

Effective YTM or EAR =

m = number of compounding periods per year; 2 in this case

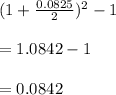

EAR =

or 8.42%

or 8.42%

Therefore, if coupons are paid annually, the coupon yield will be equivalent to the 8.42% YTM;

Effective YTM = Coupon rate = 8.42%