Answer:

14.87%

Explanation:

For compound interest amount at the end, we have formulae as

a) annually ..

where n is the no of years

where n is the no of years

quarterly ..

Monthly ..

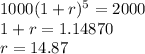

b) Equate The formula there with P = 1000 to 2000

annually

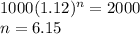

In apprxy 6 years and 2 months

Semi annually

Or in 5 years 9 months

Quarterly

C) In 5 years the money becomes double

i.e.