The manager may reject a proposal utilizing ROI that perhaps the manager accepts the use of recurring revenue.

Explanation:

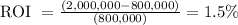

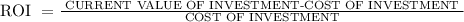

Return on investment is a measure of quality that is used to determine investment efficacy or evaluate a variety of different assets with quality. ROI attempts, by comparison with investment costs, to accurately measure the returns of a particular transaction. For order to calculate ROI, the investor's gains (or returns) are distributed between the investment costs. As a percentage, the outcome is shown.

For example, a shareholder is buying an

worth of property. The investor sold the estate at

worth of property. The investor sold the estate at

two years later.

two years later.