Answer:

The fair value of the warehouse at June 30th, 2018 is 4,100,001 dollars

Step-by-step explanation:

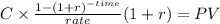

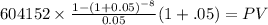

We have to calculate the present value of annuity-due (first payment is done at the beginning of the period) for eight payment of 604,152 dollars at 10% discount rate

C 604,152.00 dollars

time: 4 years x 2 payment per year: 8

rate: 10% annual thus: 0.10 / 2 = 0.05 semiannual rate

PV $4,100,001.0608