Answer:

$1,200

Step-by-step explanation:

Cost of the equipment purchased = $15,000

Useful life of the machine = 3 years

Salvage value = $600

Now,

Using the straight line method of depreciation

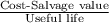

Annual depreciation =

=

or

= $4,800 per year

Now total duration from January 1 to March 31 = 3 months or

years

years

= 0.25 year

Therefore,

The accumulated depreciation = Annual depreciation × Duration

= $4,800 × 0.25

= $1,200