Answer:

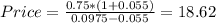

d) $18.62

Step-by-step explanation:

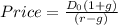

Hi, first, let´s introduce the formula to find the price of this stock.

Where:

Do = Last Dividend

g = growth rate

r = cost of equity

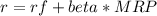

We have almost everything, all we need to do is find "r". That is:

Where:

rf = risk Free rate

MRP = market risk premium.

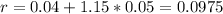

So, we find r first as follows:

therefore, r = 9.75%. Now we are ready to find the price of the stock.

The price of this stock is $18.62

Best of luck.