Answer:

e. 7.70%

Step-by-step explanation:

With the market alue and the yield to maturity we can solve for the coupon rate:

the bond price is compose of the maturity present valeu and the present value of the coupon payment:

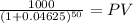

maturity:

Maturity 1,000.00

time 50.00 (25 years x 2 payment per year)

rate 0.04625 (9.25% annual /2 = semiannual)

PV 104.2861

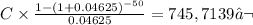

The coupon payment should be:

850 - 104.2861 = 745,7139

Coupon payment

C 1,000 x coupon rate / 2 payment per year

time 50

rate 0.04625

C = 38.505

face value x bond rate / 2 = coupon payment

1,000 x bond rate / 2 = 38.505

bond rate = 0.07701 = 7.70%