Answer:

option (C) $1,806,666.67

Step-by-step explanation:

Data provided in the question:

The overall capitalization rate = 7.5% = 0.075

The projected first year net operating income (NOI) for the subject property

= $135,500

Now,

using the direct capitalization

The indicated value of of the subject will be

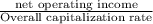

Value =

Value =

or

value = $1,806,666.67

Hence,

The correct answer is option (C) $1,806,666.67